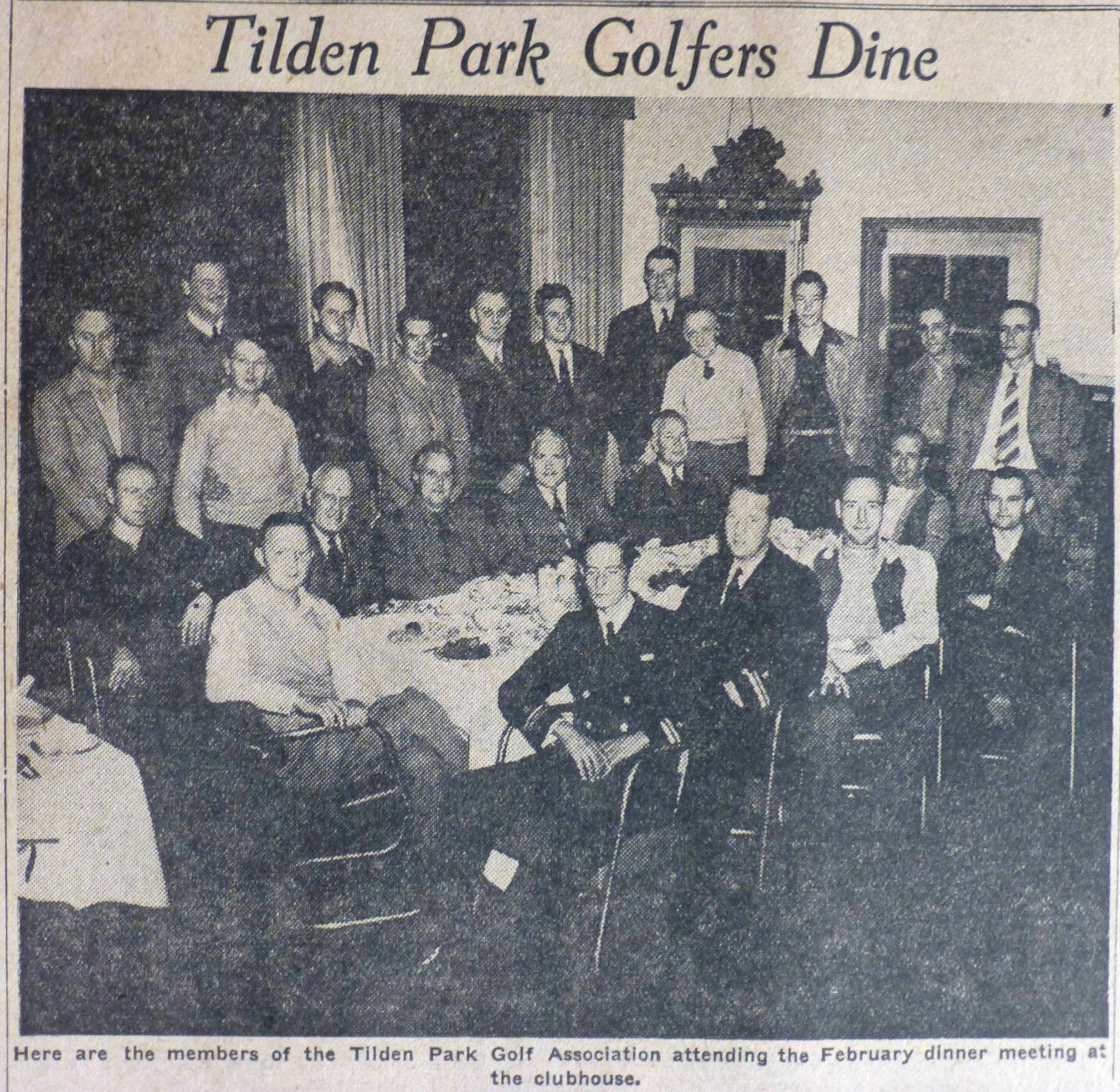

Welcome to the Club

Tilden Park Golf Club

About Us

Memberships

Tilden Park Golf Club has 2 main levels of membership: Eagle and Albatross. See their difference below.

Albatross Membership

• All the benefits of Eagle Membership plus

………

• Ability to participate and win prizes in all weekly TPGC organized events at Tilden Park and Away Days at local courses in the surrounding area

• Participation in Thursday evening Stableford league

• Preferred Sunday morning and Thursday evening tee times at Tilden Park

$165/yr

Eagle Membership

• USGA Handicap Index and GHIN handicap tracking

• Ability to participate in NCGA Qualifying evens with the chance to represent TPGC at regional NCGA events

• Membership in the (NCGA) Northern California Golf Association and discounted fees at Poppy Hills and Poppy Ridge

• Access to NCGA events including NCGA Play, Weekend Net & Champions Tours

• NCGA Exclusive discounts